Prime Sponsors: Senators Winter & Coleman and Representatives Yadira & Gray

(Updated) Status as of April 15, 2022

HB1305 passed the House and has been introduced in the Senate. It has been assigned to Senate Finance.

What is the problem that HB1305 seeks to solve?

Financial stress on Colorado businesses due to COVID disruptions is unequal but widespread. The new FAMLI program will be rolling out at the same time as businesses are trying to recover. It will require an additional payroll tax on employees. Employers must pay at least 50% of that tax contribution.

Background

Prop 118, Paid Family and Medical Leave, passed as a ballot initiative in November 2020. The first stage is a mandate to fund the program before it begins to accept claims and pay out benefits. This will require employers and employees to submit payroll taxes one year in advance to build the new program’s fund before it goes fully live starting January 1, 2023.

Key Provisions

HB1305: Paid Family and Medical Leave Premium Reduction

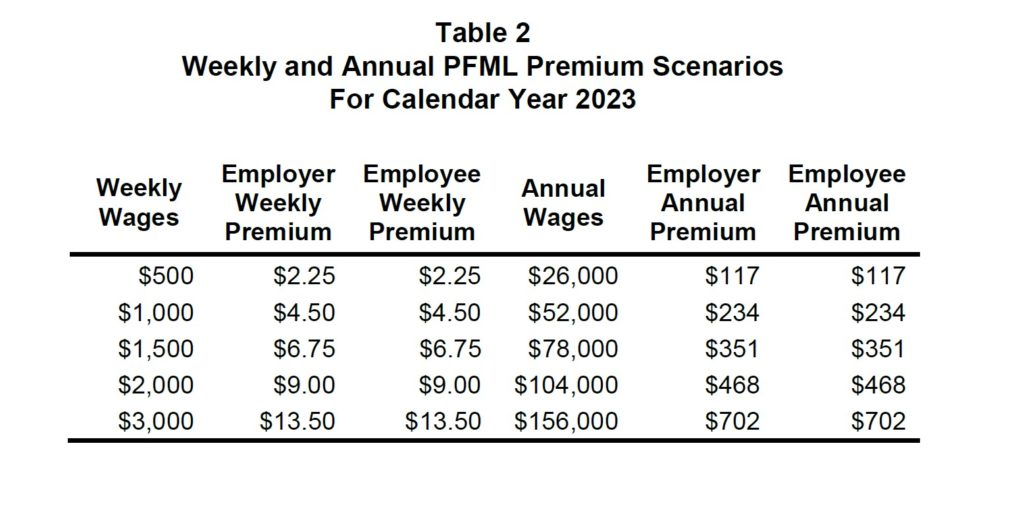

- Reduces the payroll tax obligation for employers who must pay at least 50 percent of the tax obligation from .9 percent to .81 percent for six months, from January 1, 2023, to June 30, 2023. At this time, the original obligation goes into effect.

- The law requires employers with ten or more employees to pay at least 50% of the total tax obligation.

Note: even though employers with between 1 – 9 employees must comply with all the other terms of the program, they are not required to contribute their half of the employee’s premium contribution. - The impact of the discount to the employer on an employee making $52,000 a year, is $11.70.

- For an employer with ten employees, this total discount is $234.00.

- Each year, the Division will evaluate the health of the fund to sustain the next year’s benefit obligations and have the option to reset the premium or tax for future years beginning January 2025, up to a cap of 1.2 percent unless revised through the passage of legislation.

- The law requires employers with ten or more employees to pay at least 50% of the total tax obligation.

Proponents claim

A discount will provide relief to businesses.

Opponents claim

Any savings is helpful when so many businesses are under financial stress. But this discount is dwarfed by the expenses imposed by State Leadership and recently passed legislation, including multiple new compliance regimes and tax increases.

For example, employers anticipate a heavy tax increase to support the other social risk fund managed by the Colorado Department of Labor, the Unemployment Insurance Trust Fund. This is a significant concern for businesses trying to recover and rehire to meet former staffing levels.

Together, these two tax obligations – to support the new Paid Leave Fund and the repair of the indebted Unemployment Insurance Trust Fund – will raise the costs of doing business in Colorado. It will make companies that operate here less competitive than their peers in other states.

The tax burden on labor will put downward pressure on the demand for new hires and encourage substitution with capital, including automation and AI, or avoidance of hiring, which could retard growth – especially for small businesses.

The energies of the legislature should instead be directed toward these more extensive tax obligations.

Conclusion:

Because much of the information is held privately, small independent businesses’ health and financial status are not clear but critical. Uncertainty for future revenues makes the state economy and employment fragile. There are currently ample public funds that could be dedicated to the support of the State’s job creators. These decisions lie with the Legislature.

HB1305 is an inadequate gesture that may give the appearance of supporting small businesses, but not in the context of the mounting burdens endorsed and championed by the majority of the General Assembly and the State’s elected officials.

What’s more, the trivial discount reveals the widening gap in experience and awareness between the majority lawmakers and the employers that must implement their aggressive policies. Proponents cannot grasp the extent of likely negative consequences. Consensus grows that these policies will be unsustainable over time.

Will more legal remedies to address harassment at work build trust and opportunity?

Will more legal remedies to address harassment at work build trust and opportunity?